Our Focus: Your Financial Well-Being

People often think an advisor’s main focus is investments. But the reality is that investments make up just a single piece in a much larger puzzle. Investments require thought, time, and attention, but there are in fact other areas to your financial life, and these may be areas where you have both more influence -- and more control. At Clarity Northwest, we believe it's important to look at each of these different areas, not all at once necessarily but, over time, examining how they fit together within a larger whole, within the context of your life and your goals, so that you can achieve greater financial well-being.

So what measures, taken all together, over time, can best help you achieve financial well-being? We believe these measures include:

So what measures, taken all together, over time, can best help you achieve financial well-being? We believe these measures include:

1. Setting Clear Goals & Priorities That Recognize Evolving Life Stages & Timeframes

We will always have more demands on our resources than most of us can reasonably meet and the first step in the path to financial wellness lies in developing clarity around what you want your money to do for you. This typically comes down to personal values which may shift or change as you move through life.

|

For some, money is all about security. For others, it’s about peace of mind. Or financial independence. Or taking care of others. Or an artful balance of all the above.

Whatever mix is right for you, the clearer you are about your values around money, the easier it should then be to identify the specific financial goals that will help you realize and live your values. Thinking this through, quantifying and prioritizing financial goals, and placing them within a meaningful timeframe, can help you sort through the inevitable trade-offs you may need to make if you wish to achieve your goals. 2. Working Toward a Healthy Financial Position Appropriate to Your Age & Goals

|

We all work to find the right balance, allocating scarce resources amongst past, present, and future obligations. With a surplus of resources, we may decide to pay off obligations from the past. Or indulge ourselves in the present. Or hold money aside, in reserve, for emergencies. Or save and invest for the future.

|

Lacking sufficient resources in the present, we may either tighten our belts, or borrow, taking on obligations that place demands on both present and future resources. When and how much debt one assumes is a balancing act. There are times in life when debt makes more sense than others. How much debt can you afford? And how far into the future should you extend that debt? While debt sometimes makes sense, too much debt can also be unhealthy.

These are all questions having to do with timing, proportion, and balance. |

|

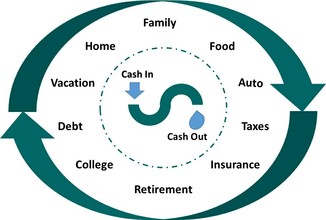

3. Managing On-Going Cash Flows So That You're Gaining, Not Losing Ground

Beyond finding a healthy age appropriate balance of resources and obligations, we all have to find the right balance between current on-going, incoming cash -- and demands on that cash. We all have basic on-going needs such as food, clothing and shelter. We also have on-going fixed obligations, whether that’s paying down debt or paying our share of taxes. Then too there are all those other discretionary expenses that may be optional, but give us great pleasure. At the end of the day (or year), it’s important to know, between all the money flowing in and out, that you’ve left yourself room to cover the present – whether that’s an unanticipated expense, a bigger than expected tax bill, a crisis, or something else – while you still have something left to save for the future. |

4. Investing Savings in a Cost Effective, Diversified Mix Matched To Your Timeframe & Risk

|

Whether you already have enough savings or you’re currently saving, it’s important to be sure you’re putting savings to work in a way that factors in your willingness, ability and need to take risk, increasing your odds of meeting your near, mid, and long-term goals. No, a planner cannot guarantee you will achieve all your goals any more than a sailor can guarantee the time it takes to cross an ocean or if you’ll arrive at the other side. But a good planner can, like any good navigator, help equip and position you, as much as it’s possible, for success, helping you minimize unnecessary costs and risks, while also being smart about taxes. How much do costs matter? Just 2% in fees, paid year over year, over a span of thirty-five years will reduce your wealth by half. Yes. Half. Costs matter.

|

|

5. Managing Risks Beyond Your Investments

Beyond market risk, there are of course other risks we face as we go through life. This might be the risk of a serious illness that impedes our ability to earn or that has the potential to deplete our life savings. Or it might be the risk of losing a family’s provider and sole source of support. There are different ways and degrees to which we can go to protect ourselves against some of these more catastrophic risks. Knowing when and how much we need to insure and protect ourselves against these risks requires both qualitative and quantitative skills.

6. Thinking Through Estate Planning Choices & Implications

|

|

A well thought out estate plan not only helps address how to take care of loved ones in our absence, it can also help address how we’d want medical and financial questions handled in the event of incapacity. Will your loved ones be able to advocate for you? Will they still be able to cover present and on-going financial obligations? There are different strategies to consider depending on your goals.

|

7. Coordinating Efforts Across All These Different Dimensions for a Healthy Financial Outlook

All the above elements are important to your financial life and should in fact work together to support your goals. While you might have an excellent investment strategy, if you’re not saving anything for the long-term this may not be all that useful. You may be resolute in your goal to save more but, if your cash flows don’t allow for it, you won’t get very far. And, if your beneficiary listings are inconsistent with your estate planning goals, you may in fact not realize these goals. Again, you may not need or wish to tackle all these different areas of your financial life all at once. You may choose to focus on one, two, or three areas at any given time. In the aggregate however, we believe this kind of holistic approach produces more coherent, more effective results.